VISUAL BRIEFING

When Waiting Becomes the Risk

A field note on sellers, psychology, and market structure Pre-Construction 24/7

Written to explain systems, not chase sentiment.

Pre-Construction 24/7

THE WARNING

Selling in 2026 is not about timing the market — it’s about avoiding structural decay.

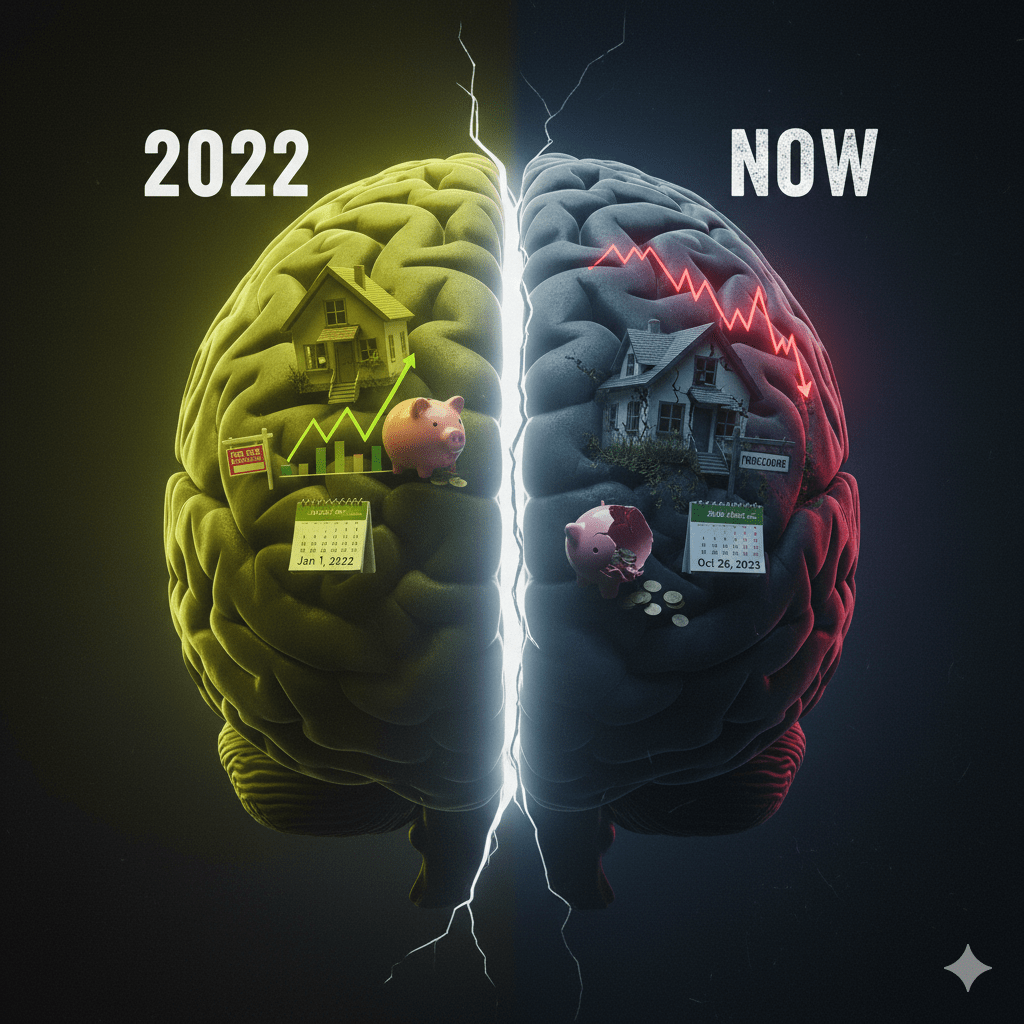

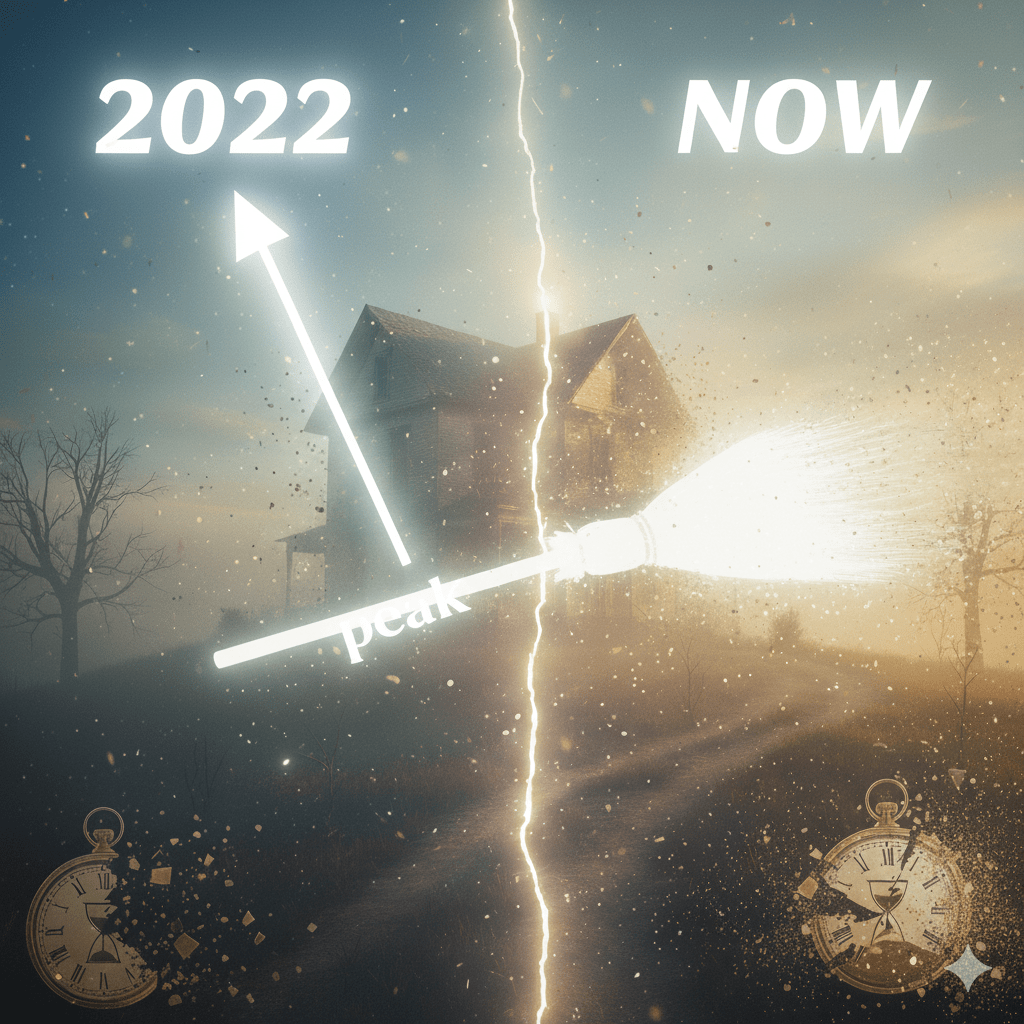

THE EMOTIONAL TRAP

Most sellers aren’t reacting to today’s prices — they’re grieving yesterday’s peak.

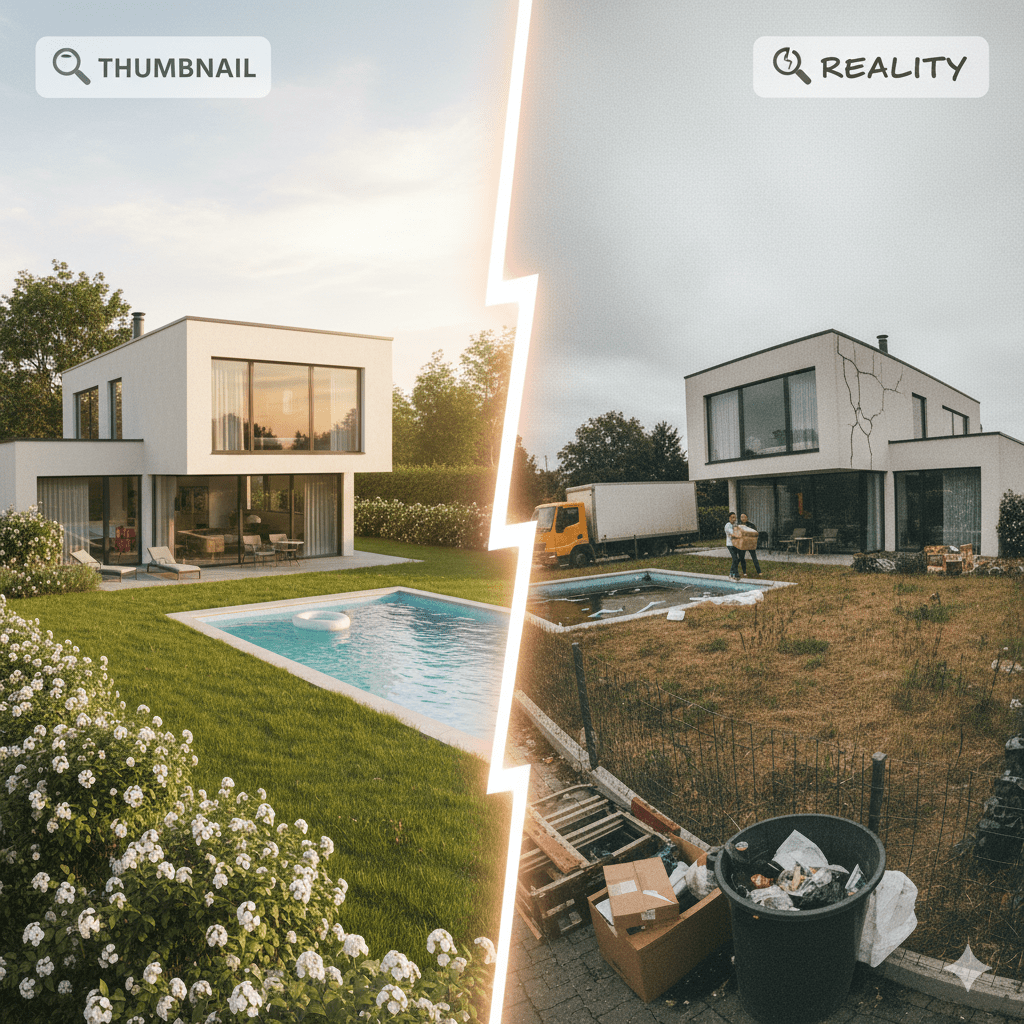

THE FALSE COMPARISON

Comparing current offers to peak pricing turns rational decisions into emotional paralysis.

THE REAL SHIFT

The market isn’t punishing bad homes — it’s filtering out mispriced expectations.

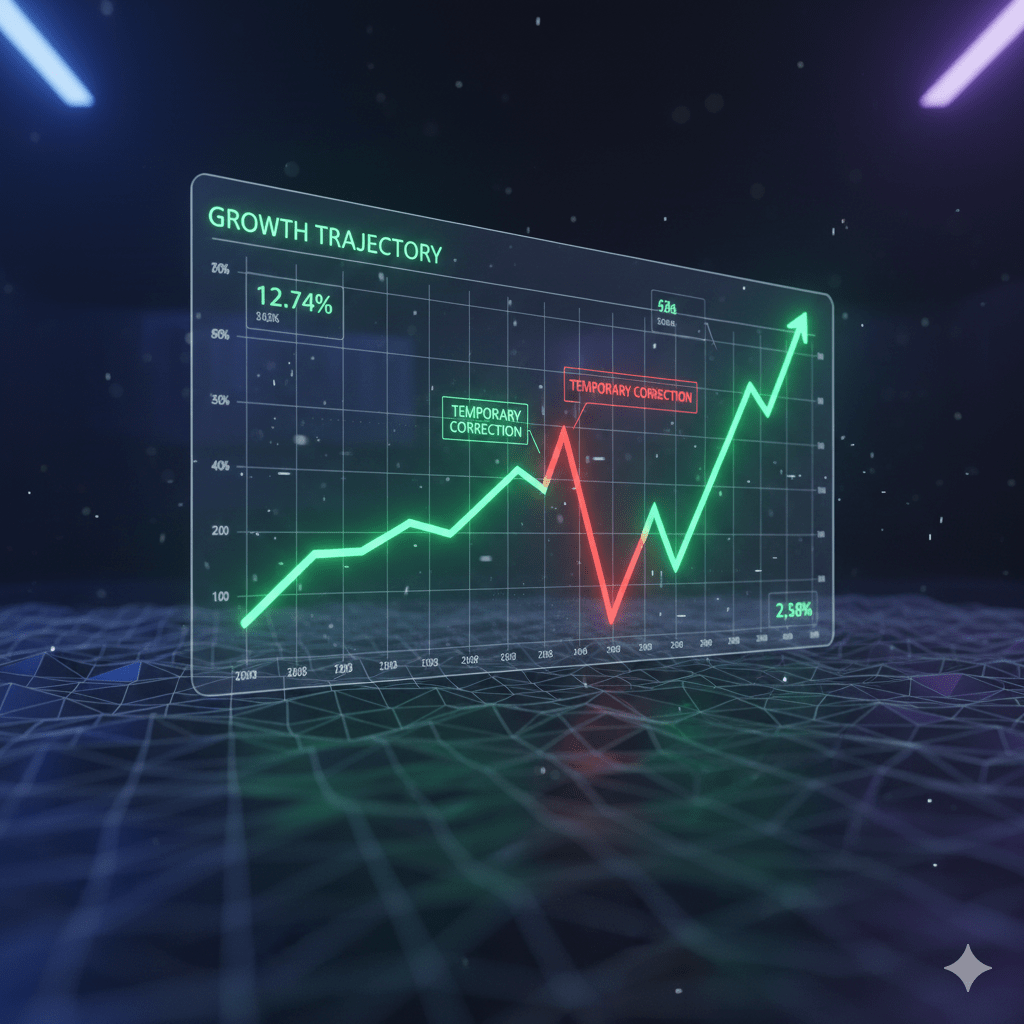

THE DATA REALITY

A $200,000 pullback feels dramatic until it’s placed inside a 10-year price curve.

THE MISSED POINT

The risk isn’t what you didn’t sell for — it’s what happens if prices grind lower.

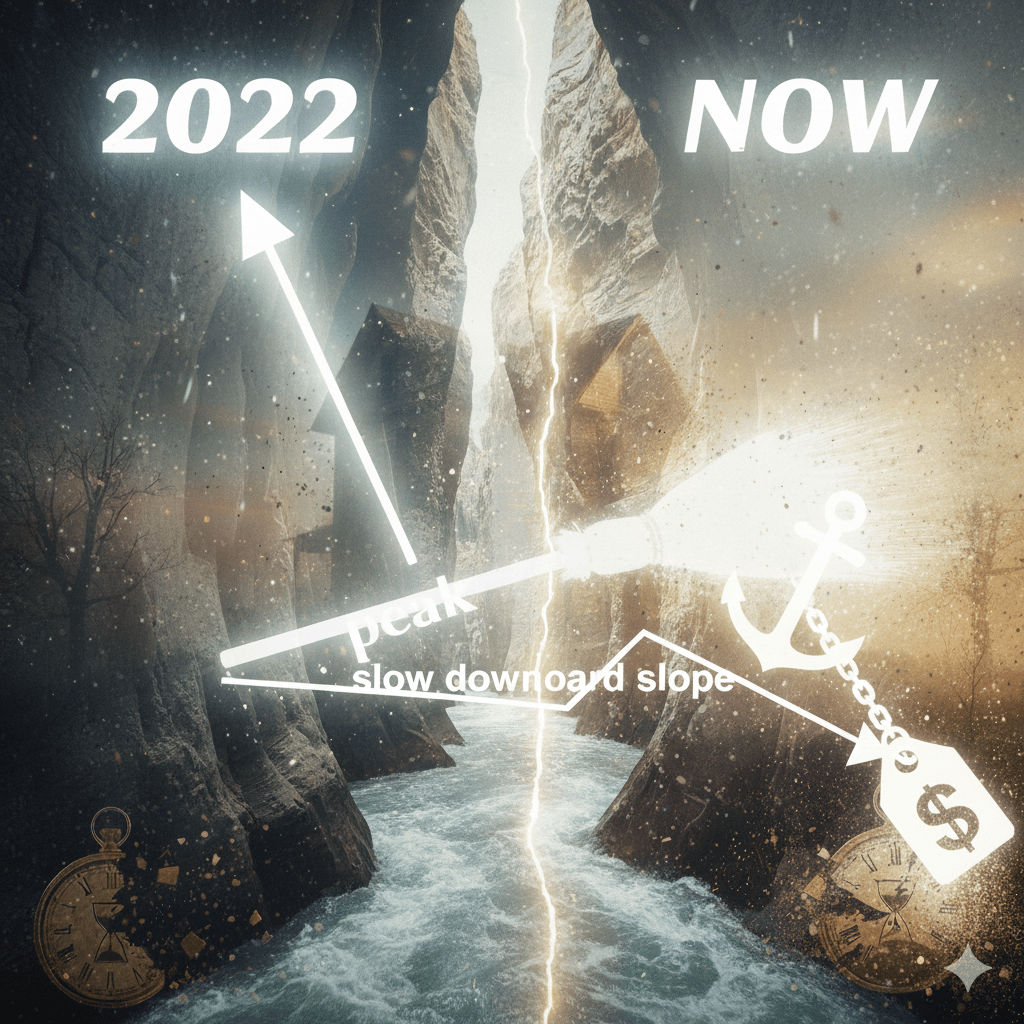

LONG-TERM OWNERS

Equity still exists, but leverage disappears when sellers anchor to obsolete numbers.

THE QUIET EROSION

Markets don’t need to crash to damage outcomes — they only need time.

RECENT BUYERS

Peak-era buyers don’t lack value — they lack negotiating room.

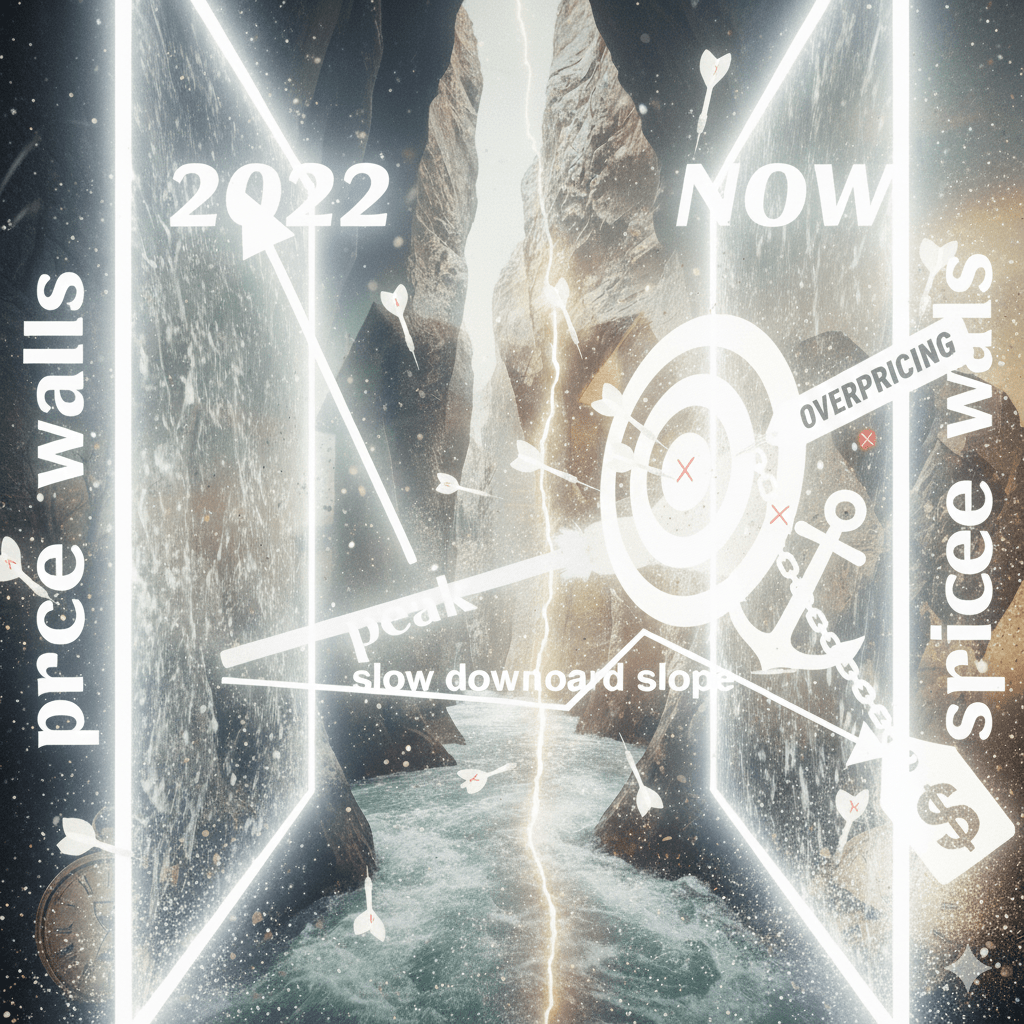

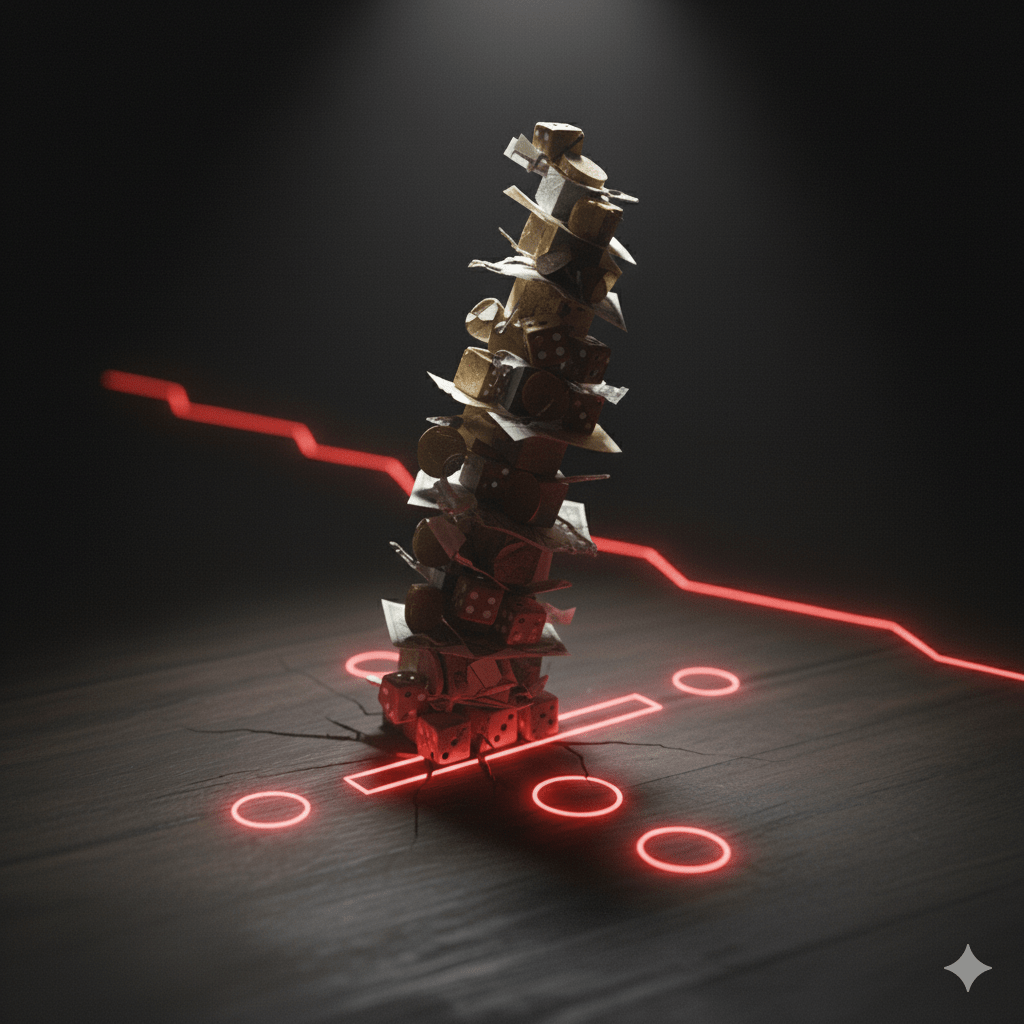

HOPE PRICING

Overpricing is no longer confidence — it’s a signal of denial.

THE INVENTORY SIGNAL

Listings that linger don’t wait for buyers — they train buyers to wait.

INSTITUTIONAL PRESSURE

Banks don’t negotiate emotions — they reset neighborhoods through data.

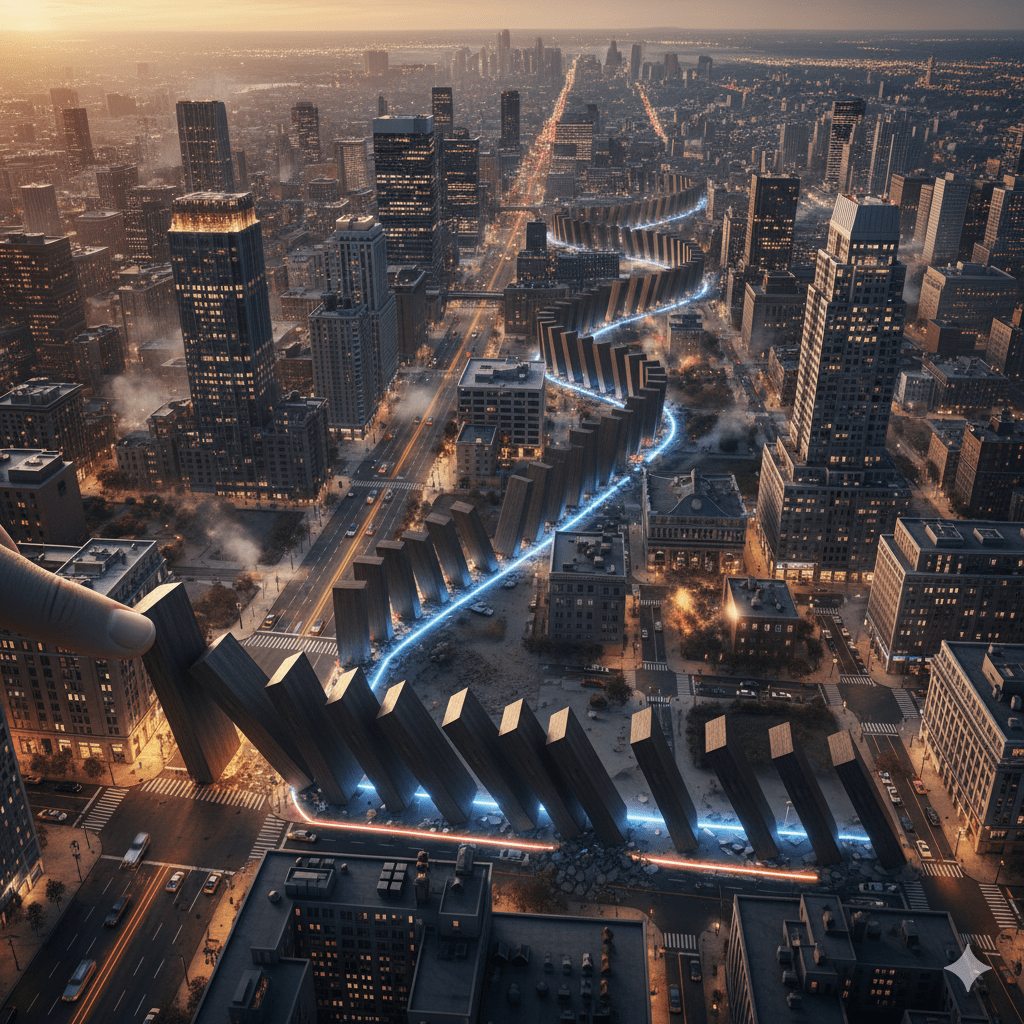

THE CASCADE

One distressed sale quietly recalibrates every appraisal that follows.

BUYER BEHAVIOR

Today’s buyers don’t negotiate overpriced homes — they ignore them.

LOST MOMENTUM

Once a home is skipped, its leverage rarely returns.

THE POWER SHIFT

High inventory doesn’t create panic — it creates patience.

THE GATEKEEPER

Pricing isn’t a tactic — it’s the admission ticket.

PRESENTATION REALITY

If a home fails online, it never reaches in-person judgment.

DISTRIBUTION TRUTH

Exposure is leverage only when it’s intentional and constant.

THE COMPOUND EFFECT

Waiting rarely preserves value — it compounds disadvantage.

THE CORE QUESTION

Are you protecting a number, or protecting an outcome?

THE CLOSE

In this market, urgency isn’t emotional — it’s structural.