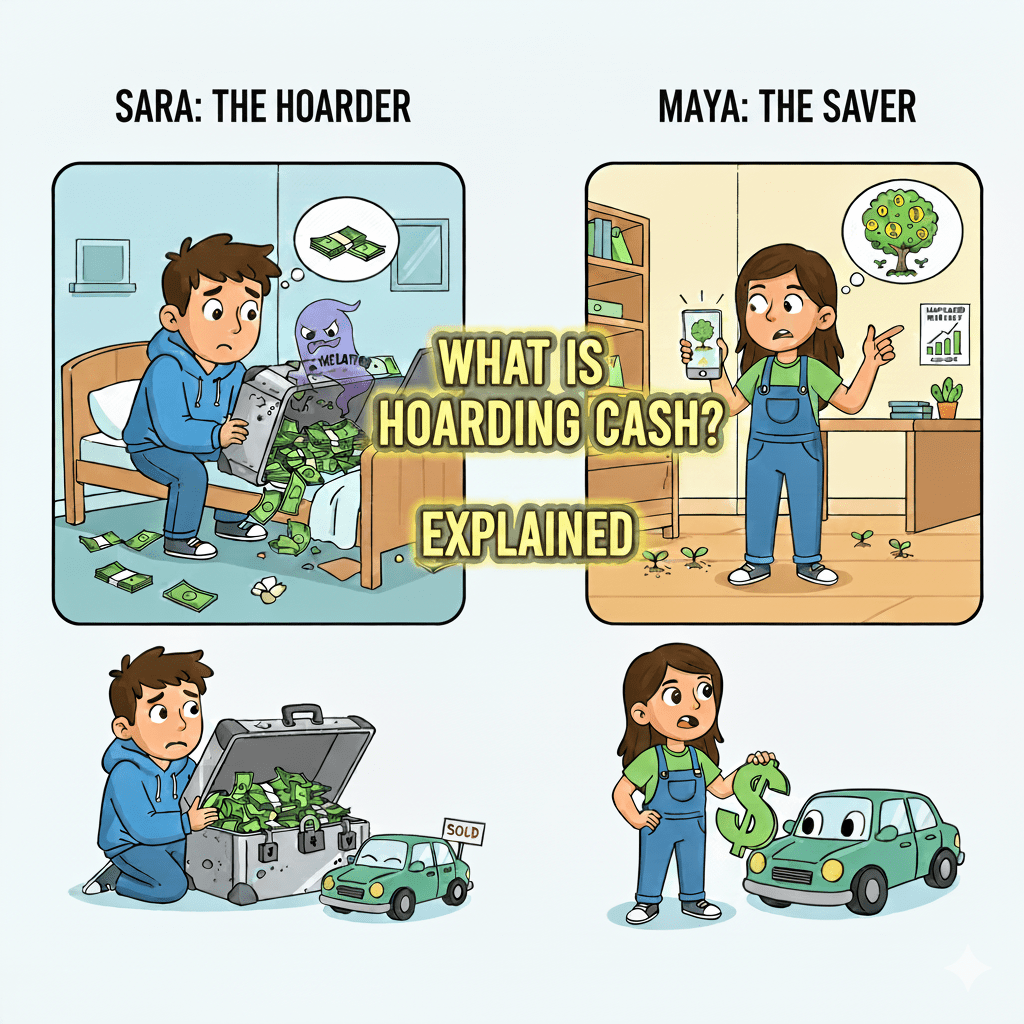

Hoarding cash is when someone keeps a large amount of physical money (like stacks of bills under a mattress or in a safe) instead of putting it into a bank account, stocks, or bonds.

People usually do this for three reasons:

- Fear: They don’t trust banks or the economy.

- Security: Having physical “green” makes them feel safe.

- Waiting: They are waiting for a “perfect” time to buy something or invest.

The Problem: The “Invisible Thief”

While hoarding feels safe, two things happen to that money:

- No Compound Interest: You miss out on the “snowball effect” where your money makes more money.

- Inflation: Because prices for things like chips, gas, and clothes go up every year, that $100 bill in your drawer actually buys less next year than it does today.

The Story of Silas and the Silver Suitcase

Once, in a busy city, lived a teenager named Silas. Silas was a hard worker; he mowed lawns, washed cars, and saved every penny. By the time he was 16, he had saved $1,000.

Silas was terrified that the world might end or the banks might disappear. So, he took his $1,000 in crisp twenty-dollar bills, locked them in a Heavy Silver Suitcase, and slid it under his bed. He felt powerful knowing his “treasure” was right there.

His best friend, Maya, also saved $1,000. But Maya wasn’t afraid. She “planted” her money in a simple investment account that earned a modest 7% interest every year.

Five Years Later…

Silas and Maya were 21 and graduating from college. They both decided it was time to use their savings to buy their first used cars.

- Silas pulled out his Silver Suitcase. He opened it, and there it was: exactly $1,000. He was proud! But when he went to the car lot, he realized that a car that cost $1,000 five years ago now cost $1,150 because of inflation. His money hadn’t grown, but the world had gotten more expensive. He couldn’t afford the car.

- Maya checked her account. Because of compound interest—the “magic” of her money making its own babies—her $1,000 had grown to about $1,400.

The Lesson

Maya bought the car and had $250 left over for gas and snacks. Silas had to go back to work.

Silas realized that by “protecting” his money in a suitcase, he had actually punished it. He kept it idle and lazy while Maya’s money was out there working a 24/7 job for her. Silas learned that while it’s smart to have an “Emergency Fund” (a small pile of cash for a rainy day), hoarding everything just lets the “Invisible Thief” of inflation steal your future.

Summary for Your Friends

- Saving is putting money to work so it grows.

- Hoarding is keeping money under your bed where it “shrinks” in value because it can’t keep up with rising prices.