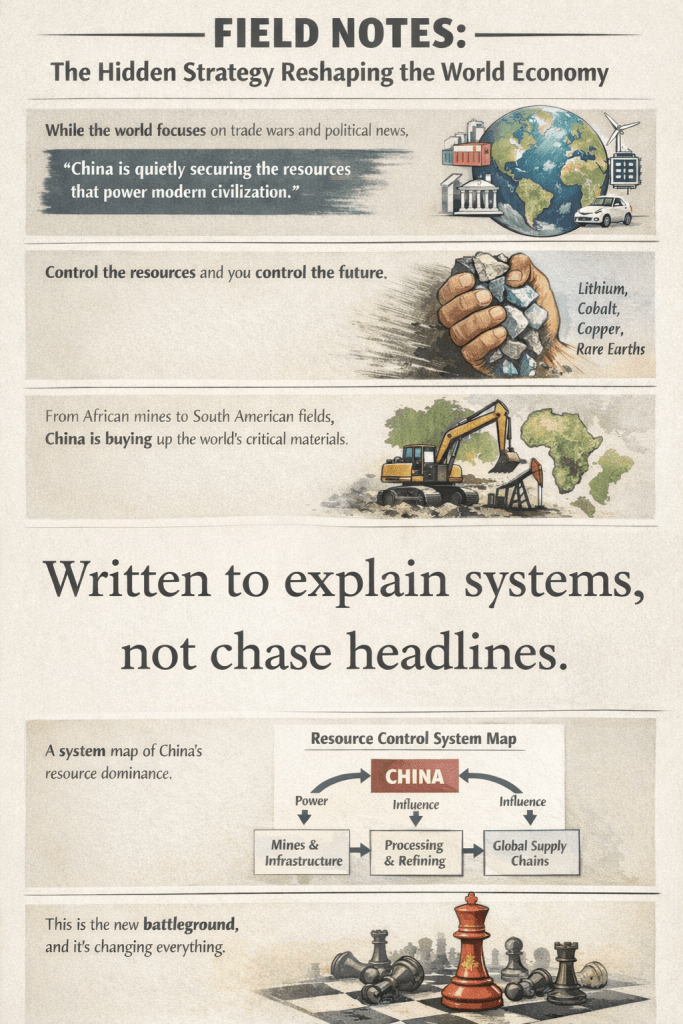

Most people watch trade wars, elections, and market volatility.

Meanwhile, a far quieter shift is underway—one that doesn’t need headlines, speeches, or conflict to succeed.

Economic power is moving away from paper claims and toward physical control.

Not control of companies. Not control of markets.

Control of materials.

This is not theory. It is not fear.

It is visible in supply chains, commodity flows, and capital movements happening right now.

The Distraction

While attention stays on politics, power is shifting beneath the surface.

The Strategy

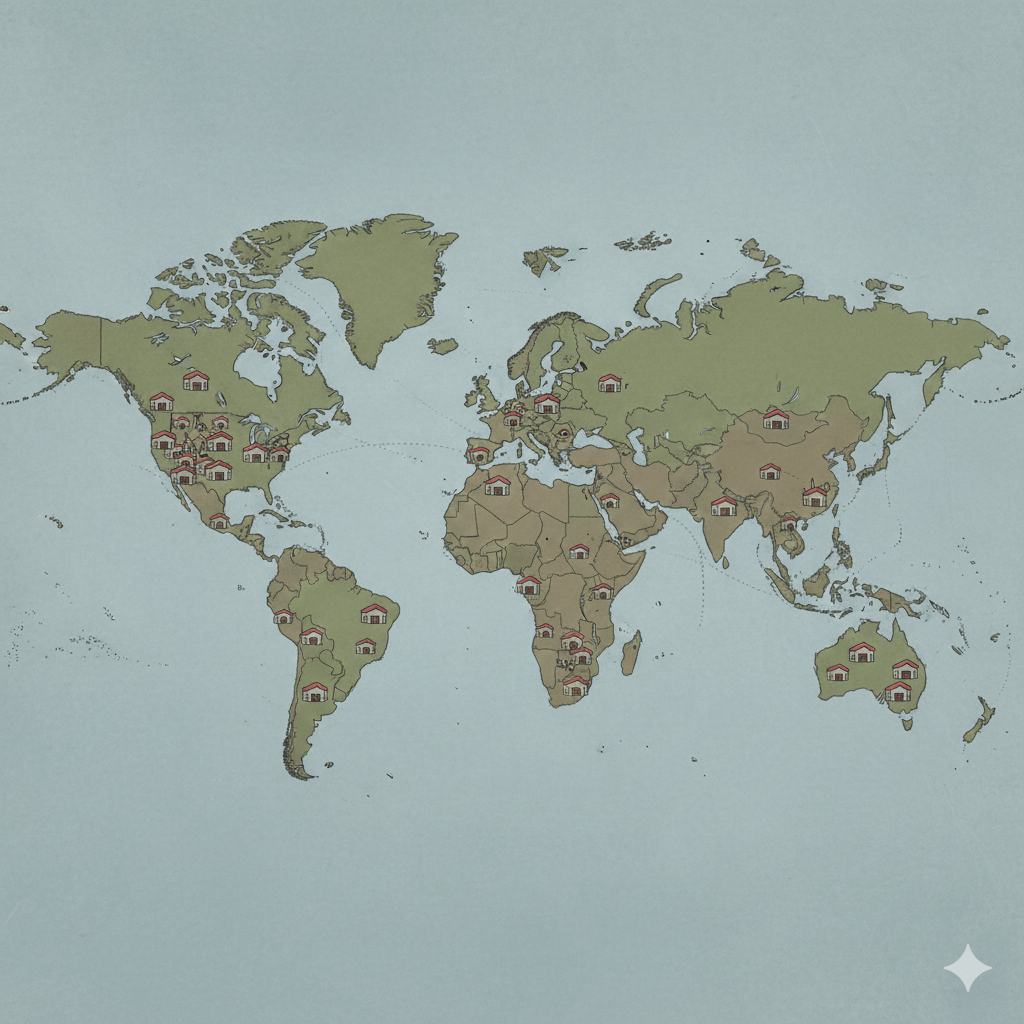

China is systematically securing the raw materials that modern civilization depends on.

The Leverage

Whoever controls materials controls manufacturing, pricing, and innovation.

The Materials

Semiconductors, energy, defense, medicine, and transport all rely on scarce metals.

The Method

This is not speculation—it is long-term stockpiling backed by state policy.

The Currency Shift

Each purchase converts paper dollars into physical, strategic assets.

The Dollar Effect

Less demand for dollars means structural pressure, not temporary weakness.

The Signal

Silver exposes the system because physical demand is colliding with paper promises.

The Behavior

When trust fades, people pay premiums to own what they can actually touch.

The Pattern

Silver is not unique—it is simply the most visible example.

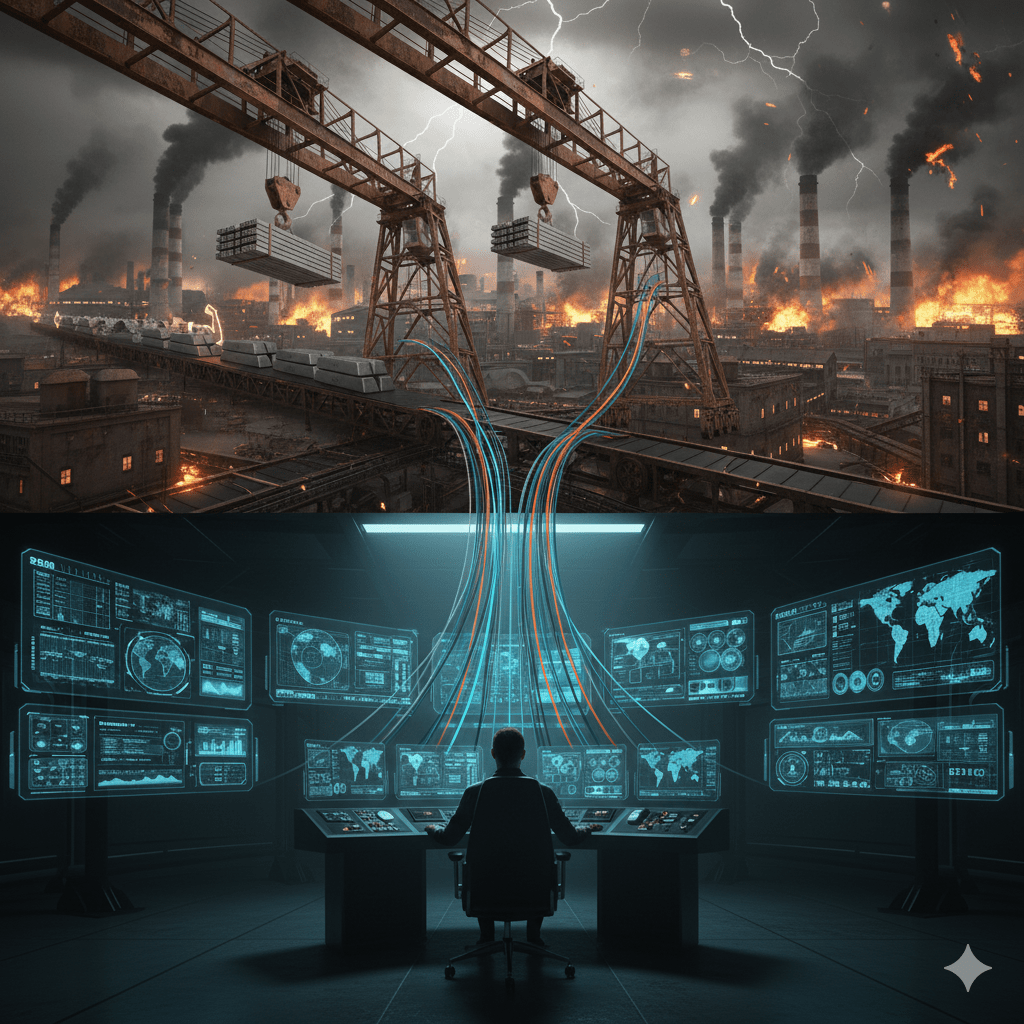

SYSTEM MAP — HOW THE SHIFT WORKS

Dollar Reserves

↓

Resource Purchases

↓

Supply Chain Control

↓

Industrial Power

↓

Reduced Dollar Demand

↓

Currency Pressure

↺ (Feedback Loop)

This system reinforces itself—each step strengthens the next.

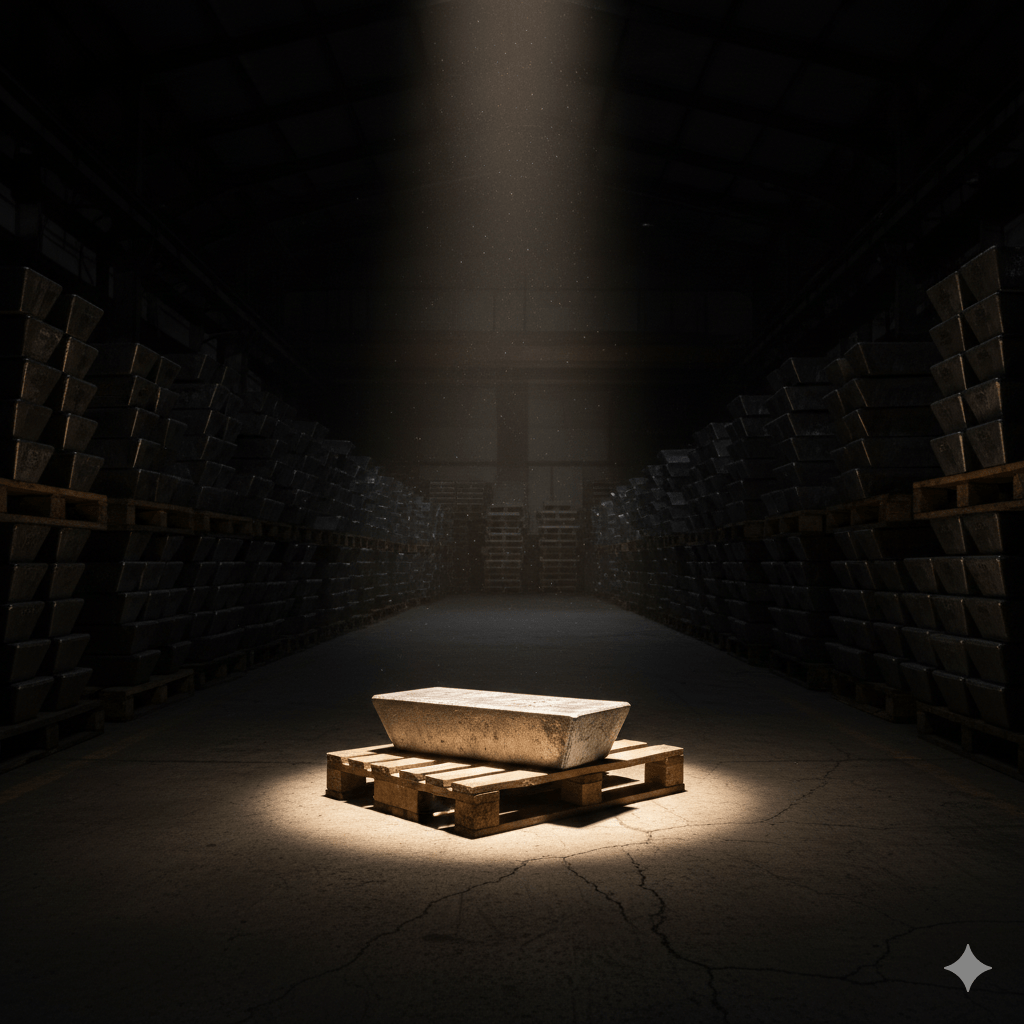

CASE NOTE — WHY SILVER MATTERS

Silver is no longer just a store of value.

It is a strategic input for energy, electronics, defense, and medicine.

When paper claims multiply faster than physical supply, markets don’t fail politely.

They break through shortages, premiums, and fear-driven behavior.

Silver shows what happens when trust shifts from promises to possession.

Economic power follows materials, not money

Paper wealth depends on trust; physical assets depend on reality.

If supply chains are controlled, markets become optional.

The quiet strategies shape the loud outcomes.

What looks like patience is often preparation.

THE FIELD NOTE

This is not a prediction. It is a transition already in motion. The global system is slowly repricing what matters:

- Claims versus control

- Paper versus physical

- Speed versus patience

Periods like this do not reward reaction. They reward understanding. Those who see systems early don’t panic later.