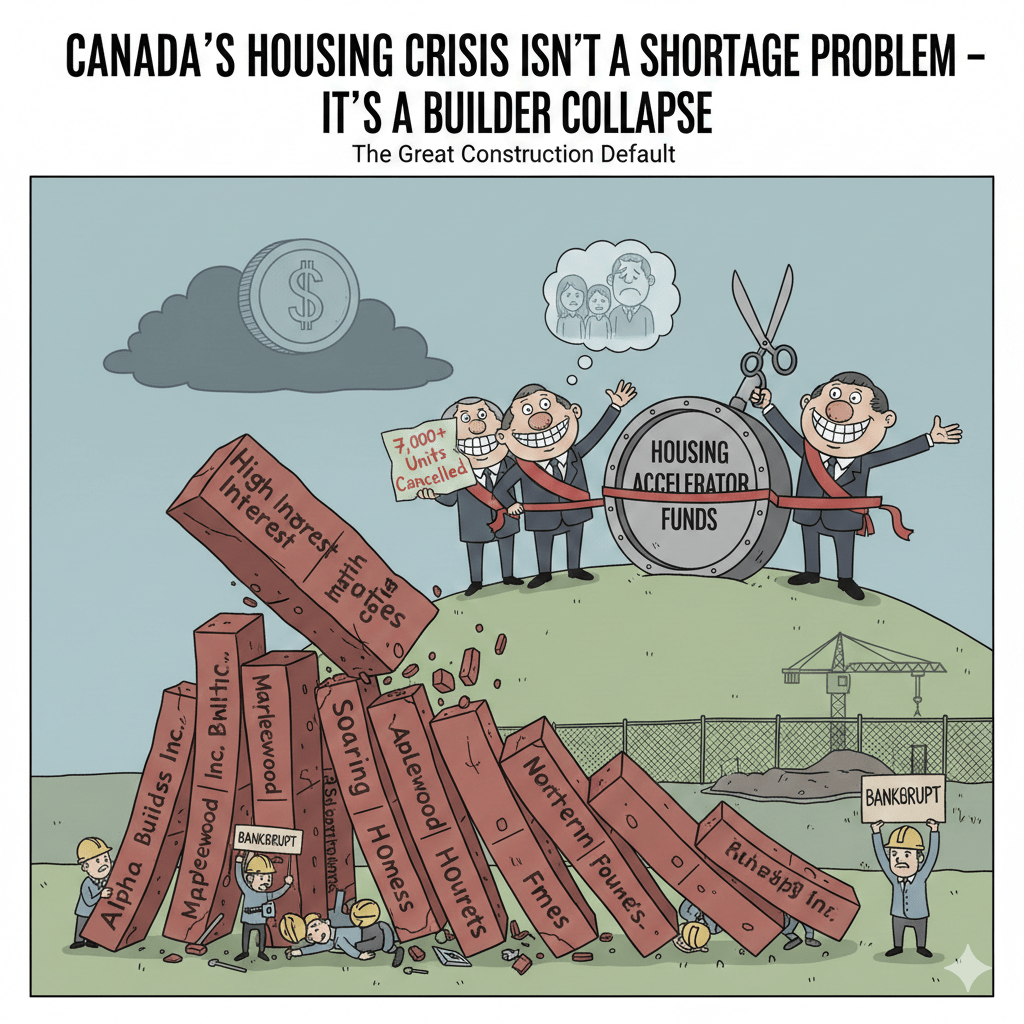

What if the real reason Canada’s housing crisis keeps getting worse isn’t demand, immigration, or even affordability—but the collapse of the companies that actually build homes?

What if billions of dollars in government housing funding aren’t disappearing due to corruption, inefficiency, or mismanagement—but because the economics of homebuilding have become mathematically impossible?

The Silent Collapse No One Is Talking About

In 2025, Canadian business insolvencies reached a 15-year high. But the story behind the numbers is more alarming than the headline suggests.

This surge was not driven by restaurants, retail, or consumer businesses. It was driven by construction.

Construction insolvencies jumped over 30% year-over-year, triggering what can only be described as a mass extinction of homebuilders—the very companies politicians rely on to deliver housing supply.

Construction insolvencies surged over 30% year-over-year, signaling deep structural stress.

📈 Insolvency Chart — Canada (2020–2025)

| Year | Total Insolvencies | Construction Insolvencies | % Change YoY (Construction) |

|---|---|---|---|

| 2020 | 11,200 | 1,500 | — |

| 2021 | 10,900 | 1,450 | -3.3% |

| 2022 | 12,300 | 1,380 | -4.8% |

| 2023 | 13,400 | 1,650 | +19.6% |

| 2024 | 14,500 | 2,100 | +27.3% |

| 2025 | 15,800 | 2,740 | +30.5% |

Source: Canadian Business Insolvency Reports (2025)

The Scale of the Housing Destruction

Since the start of 2024:

- Nearly 7,000 pre-construction condo units in the Greater Toronto–Hamilton Area have been cancelled

- New condo sales have fallen to a 35-year low, not seen since 1990

- The housing supply pipeline for 2028–2029 is effectively empty

This is not a normal housing cycle. This is a structural fault line that will reshape Canada’s housing market for the next decade.

35K ┤

│ ██

30K ┤ ███████

Units 25K ┤ ████████ ███

20K ┤ █████ █████████ ██████

15K ┤ █████████ ███████████ █████████

10K ┤ █████████████████████████████████

5K ┤██████████████████████████████████

0 ┼──────────────────────────────────

2018 2019 2020 2021 2022 2023 2024 2025

Cancelled Units ↓

Why Government Housing Funding Can’t Fix This

Governments announce billions in housing accelerator funds.

Politicians attend ribbon-cutting ceremonies.

Press conferences promise action.

But here’s the uncomfortable truth, you can fund housing projects. you cannot fund negative math.

Much of this funding is flowing into development companies that are structurally incapable of completing projects profitably. When the underlying economics don’t work, no subsidy can save the outcome.

The Profitability Gap: The Real Housing Crisis

Here is the equation destroying Canadian housing supply:

- Construction costs are up 20%+ in just three years

- It now costs approximately $800 per square foot to build in major urban markets

- The market is only willing to pay $750 per square foot

Every new project launched under these conditions is a guaranteed financial loss.

How We Got Here: The 2021–2022 Pre-Sale Trap

During the pre-construction boom of 2021 and 2022, developers sold thousands of condo units at fixed prices, assuming long-term construction inflation would remain around 2%, as it had for decades.

Instead, they encountered 15% construction inflation. Developers signed contracts in 2022 to deliver homes in 2025 at prices that no longer cover their costs.

They cannot renegotiate. They cannot raise prices. They cannot walk away without collapsing.

What Happens When Developers Run Out of Cash

When a developer collapses, lenders appoint a receiver.

The receiver’s job is not to finish the building.

It is not to protect buyers.

It is to liquidate assets and repay the bank. Construction stops. Cranes come down.

The site sits fenced, silent, and frozen.

Buyers—many of whom put down $100,000 to $150,000 deposits—become unsecured creditors, standing behind the bank in line.

The Pre-Construction Deposit Myth

Many buyers believe their deposits are fully protected. They aren’t.

Warranty protections often cap coverage between $60,000 and $100,000. Anything above that can be lost permanently. Once a project enters receivership, resolution takes years, not months.

| Warranty Cap | Maximum Coverage |

|---|---|

| Tarion Standard (Older Agreements) | ~$60,000 |

| Updated Tarion Coverage | ~$100,000 |

| Typical Deposits at Risk | $100–$150K |

Ghost Sites:

Across Canada’s major cities, there are now sites where:

- Excavation is complete

- Foundations are poured

- No work has occurred for six months or more

These are not construction delays. They are construction tombstones—zombie projects waiting for insolvency filings everyone knows are coming.

Why This Becomes a Systemic Housing Collapse

Construction doesn’t just build condos. It builds:

- Rental housing

- Single-family homes

- Warehouses and industrial space

- Retirement and senior housing

When builders fail, entire supply chains unravel:

- Trades go unpaid

- Construction liens explode

- Small firms go bankrupt

- Projects stall mid-build

This isn’t a single crash. It’s a distributed default across the housing economy.

The Supply Shock That’s Coming Next

Housing completions lag sales by three to four years. Today’s collapse in pre-construction sales guarantees:

- No meaningful supply in 2028

- No relief in 2029

- Renewed price pressure before supply returns

The housing crisis isn’t ending. It’s reloading.

Year Completed

2026 ┤████████

2027 ┤██████

2028 ┤██

2029 ┤░

2030 ┤░

──────────────────────

Preconstruction Sales ↓

2022 ▶ 2023 ▶ 2024 ▶ 2025

The Long-Term Reality Canadians Must Face

This is no longer about affordability alone. It’s about availability. Over the next five to seven years, housing in major Canadian cities will be accessible primarily to:

- Existing homeowners

- Buyers with family wealth

- Investors storing capital

- Capital-rich newcomers

Everyone else is pushed out—not temporarily, but structurally.

The Final Truth

The government promised housing supply. Instead, it bankrupted the builders.

You cannot solve a housing supply crisis by destroying the companies that create supply.

This is not a conspiracy. It is a policy outcome. The supply air pocket is already here. Its consequences will echo for a decade.