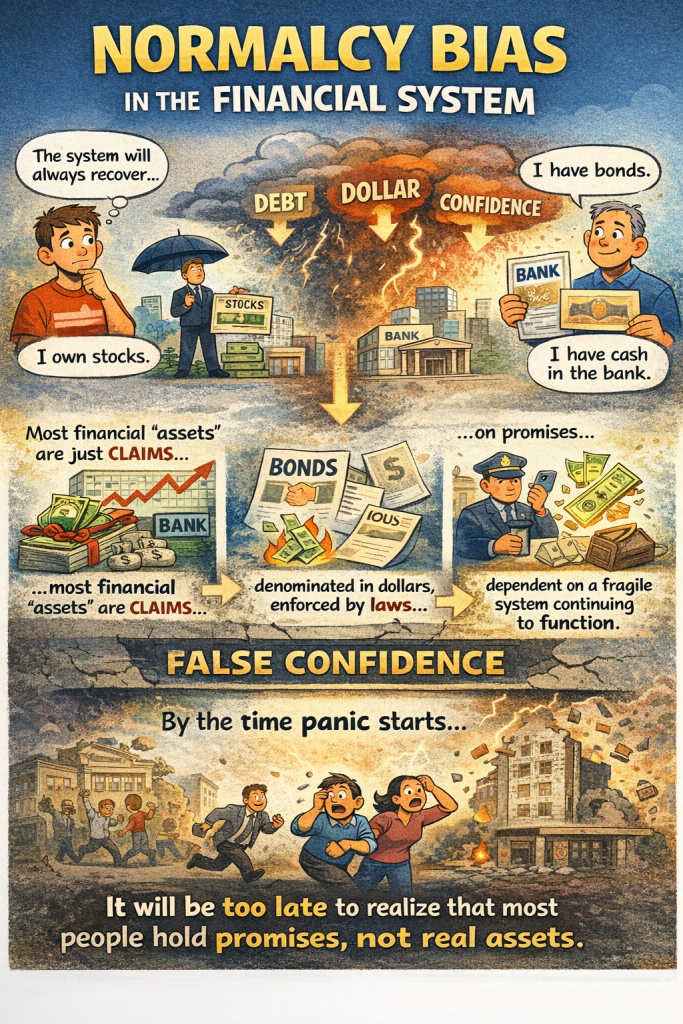

How false prosperity hides real financial risk.

Why most people don’t react: Normalcy Bias

Normalcy bias is the human habit of assuming that tomorrow will be like yesterday.

It tells us:

- “This has happened before and things turned out fine.”

- “The system always recovers.”

- “This problem is temporary.”

That’s why people stay in their homes during hurricanes:

“We’ve never had to leave before.”

Even when danger signs are obvious, the brain chooses comfort over action.

Why this instinct is dangerous in finance

Humans evolved to survive in nature, where:

- Change was slow

- Patterns repeated

- Stability usually continued

So our brains are trained to extrapolate stability.

But financial systems don’t work like nature.

They don’t slowly weaken.

They appear stable… until they suddenly break.

Banks don’t fail gradually.

Currencies don’t collapse gently.

Markets don’t warn everyone in advance.

They hold together—right up until they don’t.

By the time everyone agrees there’s a problem, it’s already too late to move safely.

That’s the trap.

What makes today different

Right now, multiple pressures are converging:

- Rising debt

- Currency debasement

- Liquidity stress

- Asset bubbles

- Confidence-based systems under strain

Each one alone looks manageable.

Together, they create systemic risk.

Normalcy bias says:

“This time will be like the last time.”

History says:

“Every system looks permanent… until it isn’t.”

The most important question most people never ask

Do you own assets — or do you own claims on assets?

This distinction is about to matter more than almost anything else.

Stocks: what you really own

When you own a stock:

- You do not own the company

- You own a financial claim

That claim is:

- Denominated in dollars

- Enforced by courts

- Dependent on markets functioning

- Dependent on the legal and financial system continuing as-is

If markets freeze, rules change, or currency weakens, your claim weakens with it.

Bonds: promises in a shrinking unit

When you own a bond:

- You own a promise to be paid dollars in the future

But those dollars are being:

- Printed in larger quantities

- Worth less each year

So even if the promise is honored, the purchasing power is quietly stolen.

You get paid back —

but you get paid back in weaker money.

Bank deposits & money market funds: IOUs, not money

When you hold money in a bank or money market fund:

- You don’t own cash

- You own an IOU

That IOU depends on:

- The bank remaining solvent

- The system remaining liquid

- Confidence remaining intact

Your money works as long as everyone believes it will.

Confidence is the foundation.

And confidence can disappear fast.

Why this all ties together

Normalcy bias keeps people believing:

- Their money is safe

- Their assets are real

- The system will adjust in time

But financial systems are confidence machines.

Once trust cracks, reactions become sudden and violent.

The danger isn’t panic.

The danger is waiting too long because panic hasn’t started yet.

The core takeaway

- Most people mistake numbers for security

- Most “wealth” today is paper wealth

- Most financial assets are claims, not things

And claims only work when the system enforcing them works.

Here’s the truth

Normalcy bias convinces people that tomorrow will look like yesterday, but financial systems don’t warn you before they break—and most people don’t realize they own promises, not real assets, until those promises are tested.