In economics, the most consequential changes often arrive quietly—without panic, without breaking news banners, without a sense of history unfolding in real time. A tariff announcement doesn’t sound like destiny. It sounds like politics. A negotiation tactic. A headline that will be forgotten by next week.

Yet when the United States doubled steel and aluminum tariffs from 25% to 50% on June 4, 2025, it may have marked one of those silent turning points.

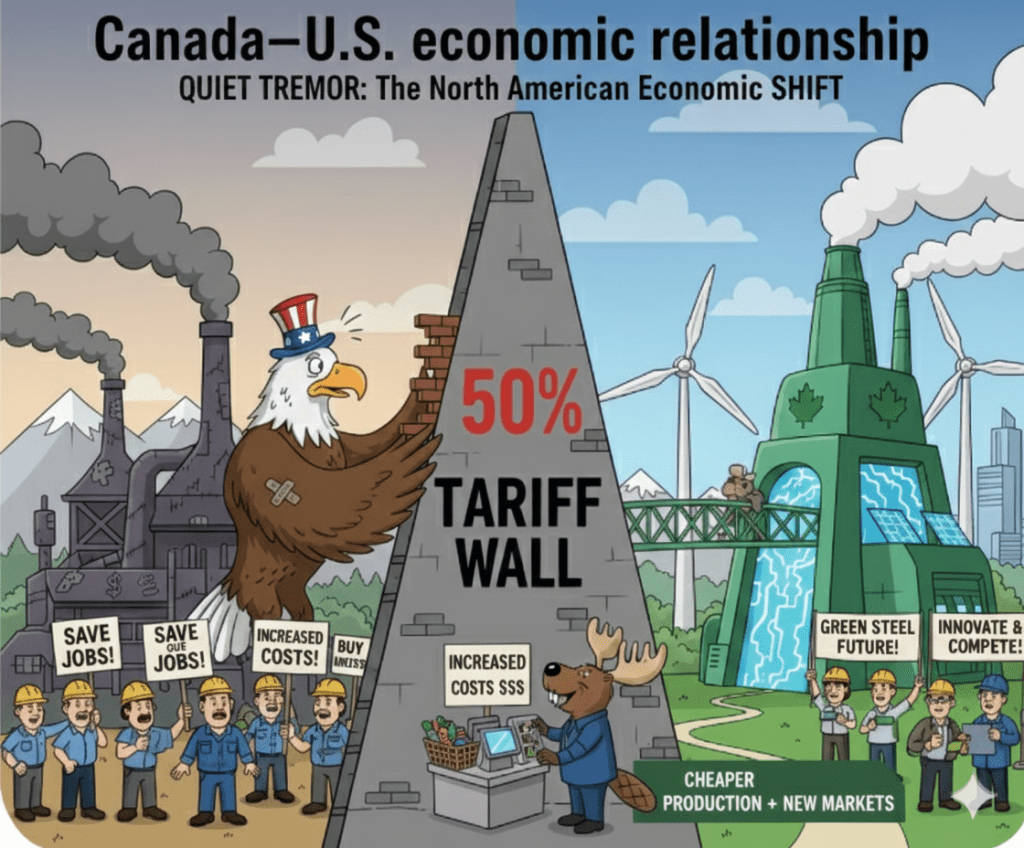

Beneath the surface narrative of “protecting American jobs” lies a deeper structural shift—one that could reshape manufacturing costs, supply chains, and the Canada–U.S. economic relationship for decades.

The 50% Wall: When Protection Becomes a Production Tax

The logic behind tariffs is centuries old:

If foreign steel is too cheap, tax it until domestic steel becomes competitive.

On paper, it looks like protection.

In practice, tariffs behave less like a wall—and more like a tax on production.

Steel is not a niche input. It is economic infrastructure. It flows through the economy the way blood flows through the body:

- Cars

- Bridges

- Appliances

- Construction

- Energy systems

- Water pipes

- Industrial machinery

When steel prices rise, the cost of being a country that builds things rises with it.

U.S. Steel Prices vs Global Prices (2025)

| Market | Price per Ton (USD) |

|---|---|

| U.S. Hot-Rolled Coil | $900 |

| Global Export Price | $450 |

Result: U.S. steel costs nearly double the world price.

This is not a rounding error. It is a structural divergence that ripples outward through the economy.

The Quiet Economic Ripple (Not the Immediate Shock)

Tariffs do not create instant factories.

A steel mill cannot expand in a week. It requires years of capital investment, regulatory certainty, and long-term demand confidence. In the gap between policy and production, the economy absorbs the shock.

Downstream Reality

For every 1 steel production job, there are approximately 80 jobs in industries that use steel as an input.

That means tariffs intended to protect one sector can quietly strain dozens of others.

Employment Exposure to Steel Tariffs

Steel Production Jobs █

Steel-Using Jobs ████████████████████████████████████████████████

(1 job) (~80 jobs)

Manufacturing, construction, transportation, appliances, and automotive industries all feel the pressure first.

The Inflation You Don’t See on the Label

Tariffs don’t always show up as a single price hike. Instead, they create “quiet inflation.”

According to 2025 economic estimates, cumulative tariffs could cost the average U.S. household approximately $3,800 per year, spread across:

- Higher vehicle prices

- More expensive appliances

- Increased construction costs

- Rising infrastructure spending

- Indirect service inflation

Estimated Annual Household Cost of Tariffs (2025)

| Category | Estimated Impact |

|---|---|

| Consumer Goods | $1,450 |

| Vehicles & Transport | $1,200 |

| Housing & Construction | $850 |

| Total | $3,800 |

No receipt says “tariff tax.” But the household budget feels it.

Canada’s Sidestep: The Green Steel Strategy

While the United States raises the price of steel through tariffs, Canada is attempting something fundamentally different: changing how steel is made.

Instead of a tariff-for-tariff escalation, Canada has leaned into Green Steel—not as environmental branding, but as industrial strategy.

Two Approaches, Two Philosophies

- United States: Shield approach — protect current industry with tariffs

- Canada: Blueprint approach — modernize production for future markets

Canada is investing heavily in Electric Arc Furnaces (EAFs) powered by hydropower and low-carbon energy.

This isn’t about climate idealism alone. It’s about cost structure.

Traditional Steel vs Green Steel Comparison

| Metric | Traditional Blast Furnace | Green Steel (EAF / DRI) |

|---|---|---|

| Primary Energy | Coal / Coke | Electricity / Gas / Hydrogen |

| Carbon Intensity | ~1.8 tons CO₂ / ton | ~0.4 tons CO₂ / ton |

| Operating Flexibility | Low | High |

| Long-Term Cost Stability | Volatile | More predictable |

| Future Trade Compatibility | At risk | Favored |

As global markets move toward carbon-border adjustments, lower-emission steel becomes commercially advantaged, not just morally preferred.

The Fork in the Road: Protection vs Innovation

This moment exposes a deeper tension in industrial policy:

- Do we protect what exists, or

- Do we build what comes next?

Tariffs can buy time. They cannot buy innovation.

If U.S. steel remains expensive while Canadian producers modernize, the paradox emerges:

The very wall designed to keep foreign steel out may push U.S. manufacturers toward Canadian suppliers who can deliver cheaper, cleaner, more predictable inputs.

North America’s Interconnected Reality

As of late 2025, North America is not a collection of isolated economies.

A car assembled in Detroit may include:

- Steel stamped in Ontario

- Engines from Windsor

- Components from Mexico

- Electronics from Asia

Disrupting one node distorts the entire system. When steel prices diverge sharply, supply chains re-route, not retreat.

Conclusion: A Pause Button, Not a Solution

A steelworker may feel protected by a tariff.

But what that worker truly needs is confidence the job will still exist 15 years from now.

Protection that evaporates with the next election cycle is not stability.

It is a pause button on uncertainty.

The real question is: Will we use the time bought by tariffs to build something better—or will we simply preserve the old model and hope the next shock never comes?

History suggests that economies which choose progress over preservation adapt. Those that rely only on walls eventually discover that walls don’t innovate.