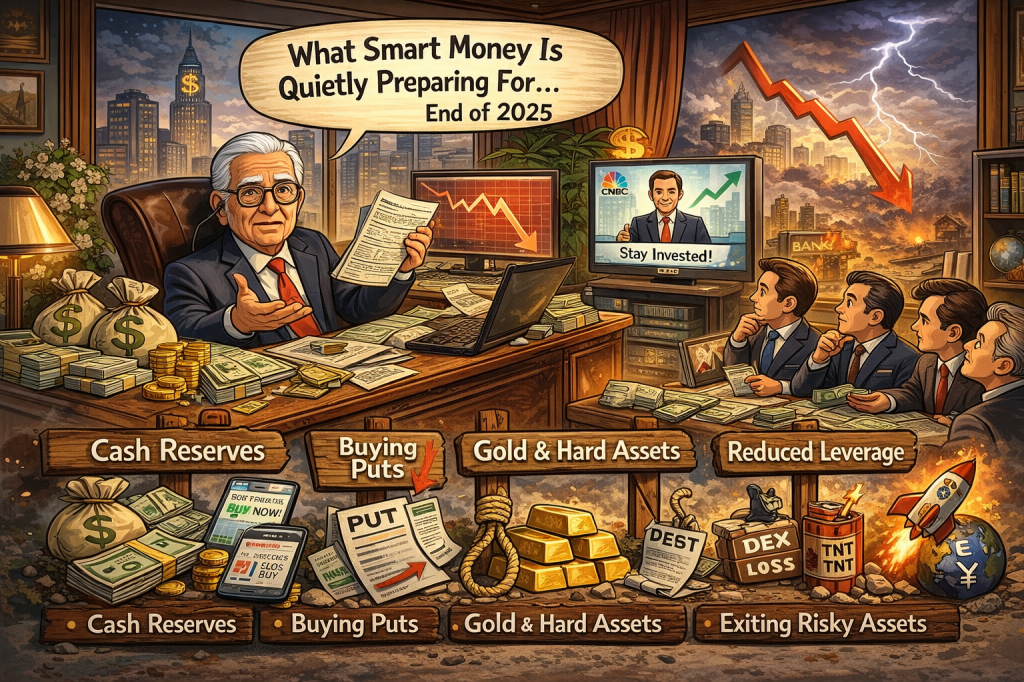

As we sit here at the end of 2025, something important is happening beneath the surface of global financial markets — largely unnoticed by mainstream media and retail investors.

There are no screaming headlines. No emergency alerts on financial television. Most advisors are still repeating the familiar message: stay invested, stay diversified, stay calm.

But behind closed doors, the behavior of the world’s most sophisticated investors tells a very different story.

Institutional investors, family offices, sovereign wealth funds, hedge funds, and ultra-high-net-worth individuals are not preparing for a normal recession. They are repositioning for systemic risk — the kind that reshapes markets, currencies, and economic power structures.

This gap between what is being said publicly and what is being done privately is now wider than it was before the 2008 financial crisis.

Why Smart Money Sees Risk Where the Headlines Don’t

Smart money does not rely on optimism or narratives. It follows probabilities, incentives, and balance sheets.

Today, several structural pressures are converging at once:

- Historically high sovereign debt levels

- Persistent fiscal deficits

- Higher-for-longer interest rates

- Fragile banking and credit systems

- Geopolitical fragmentation

- Declining trust in institutions

Individually, these risks are manageable. Together, they create non-linear outcomes — where small shocks can trigger outsized consequences.

This is what sophisticated investors are responding to.

Record Cash Positions

One of the clearest signals is how much cash smart money is holding.

Large institutions and family offices are holding 20–30% of portfolios in cash or short-term Treasuries — levels rarely seen outside late-cycle or pre-crisis environments.

Why?

- Not because they “can’t find investments”

- But because valuations don’t justify risk

- And liquidity becomes priceless during dislocations

Cash is not about return right now.

It is about optionality — the ability to act when others are forced to sell.

Example:

During 2008–2009, investors with cash bought quality assets at 40–60% discounts while leveraged investors were liquidated.

Surge in Downside Protection

Sophisticated investors are spending heavily on insurance:

- Put options on major indices

- Credit default swaps on corporate and sovereign debt

- Tail-risk strategies that pay off during extreme market stress

This is not speculation. It is risk transfer.

When the cost of insurance rises and demand keeps increasing, it reflects a belief that the probability of extreme outcomes has risen — not just everyday volatility.

Retail investors rarely see this activity, but derivatives markets often signal stress before equity markets do.

Rotation Out of Risky Assets

Smart money has been quietly reducing exposure to:

- Highly valued growth and tech stocks

- Over-leveraged companies

- High-yield (“junk”) bonds

- Smaller, credit-dependent firms

- Certain emerging markets vulnerable to a strong dollar

At the same time, they are increasing exposure to:

- Short-duration government debt

- Physical gold

- Strategic real assets

- Essential infrastructure

- Cash-generating businesses with pricing power

This is not panic selling.

It is risk compression — simplifying portfolios ahead of uncertainty.

Insider Selling

Corporate insiders — CEOs, founders, and senior executives — are selling stock at rates historically associated with market peaks.

Insiders sell for many reasons, but when selling becomes broad-based and aggressive, it often reflects concern about valuation rather than personal liquidity needs.

These individuals understand their businesses better than anyone — including future demand, margins, and capital efficiency.

Their actions deserve attention.

Central Banks and Sovereign Funds Diversifying Away from Paper Assets

Foreign governments and sovereign wealth funds have been:

- Reducing long-dated U.S. Treasury exposure

- Increasing gold reserves

- Investing in domestic infrastructure and strategic industries

- Diversifying currency exposure

This signals a gradual shift away from absolute confidence in fiat assets and toward real value preservation.

This is not an overnight collapse — but it is a structural evolution.

What Smart Money Is Actually Preparing For

Importantly, smart money is not preparing for a normal recession.

They are preparing for scenarios such as:

1. Sovereign Debt Stress

High debt + high interest rates + political gridlock = rising refinancing risk.

Governments may be forced into:

- Financial repression

- Currency debasement

- Or loss of bond market confidence

2. Banking and Credit Events

Unrealized losses, commercial real estate exposure, and leverage create fragility.

Liquidity disappears quickly when confidence breaks.

3. Currency Volatility

Reserve currencies do not fail slowly — they reprice suddenly when confidence shifts.

4. De-Globalization Shock

Supply chains optimized for efficiency, not resilience, are vulnerable to fragmentation.

This is inflationary for consumers and destabilizing for asset prices.

5. Institutional Trust Breakdown

Markets rely on trust — in policy, data, enforcement, and rule-making.

When trust weakens, volatility increases and policy effectiveness declines.

Why Smart Money Stays Quiet

This silence is not accidental:

- Speaking openly could trigger panic

- Public warnings can become self-fulfilling

- Institutional investors benefit from information asymmetry

- Advisors are incentivized to promote “stay invested” narratives

Markets often only acknowledge risk after damage is done.

What This Means for Individual Investors

This does not mean panic.

It does not mean selling everything.

It does mean thinking differently.

Smart money is focused on:

- Capital preservation

- Liquidity

- Flexibility

- Reduced leverage

- Real assets over paper promises

Key takeaway:

The goal is not to predict the exact crisis — it is to survive volatility and be positioned for opportunity.

Final Thought

Every major financial reset is obvious in hindsight — and invisible in real time to most participants.

At the end of 2025, the actions of sophisticated capital suggest we are late in a cycle where risk is underpriced and confidence is overstated.

History shows that wealth is not built by chasing the final stage of a boom — but by being prepared when the cycle turns. The window to reposition is always before the headlines change. And that window never stays open for long.