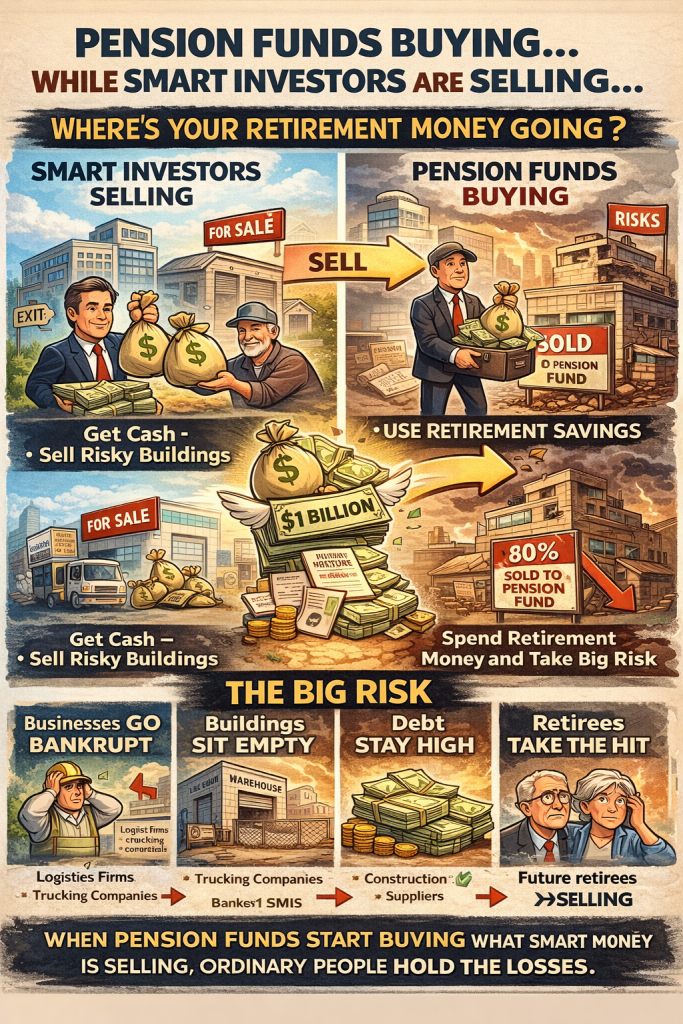

Smart investors are quietly leaving commercial real estate, but pension funds (like CPP) are buying what others want to sell. This isn’t bravery or intelligence — it’s a handoff of risk.

Your retirement money is being used so big investors can exit safely.

Imagine this:

- A group of experienced car dealers knows that used car prices are about to crash.

- Instead of holding those cars, they sell them.

- Who buys them?

A retirement fund that must keep buying cars to stay “invested.” - The dealers walk away with cash.

- If the car prices collapse later, the retirement fund eats the loss, not the dealers.

That’s exactly what’s happening here.

What CPP actually did?

- CPP put $1 billion into industrial buildings (warehouses).

- The partner company (Dream Industrial) sold its own buildings into this deal.

- Dream took 90% of the cash off the table.

- CPP took 90% of the risk.

- CPP then borrowed more money, turning this into a $3 billion bet.

If prices fall:

- CPP loses most of it.

- Dream loses very little.

Why this is dangerous?

- Tenants are failing

Warehouses are rented by trucking companies, logistics firms, and construction suppliers — many are going bankrupt right now. - Empty buildings don’t pay rent

No rent + high debt = losses every month. - Interest rates are high

Borrowing costs eat profits even if nothing goes wrong. - CPP paid full price

Private buyers are demanding big discounts. CPP didn’t.

Why pension funds do this?

Pension funds:

- Must invest money, even when markets are bad.

- Can’t sit in cash like smart private investors.

- Are judged on “deploying capital,” not avoiding losses.

So when markets run out of real buyers, pension funds become the buyer of last resort.

Why this matters to you?

If this deal goes bad:

- Losses don’t hit executives.

- Losses hit future retirees.

- That means lower benefits, higher contributions, or taxpayer bailouts.

There is no fourth option.

The big lesson

There is a difference between:

- Owning assets (things you directly control)

- Owning claims (promises someone else will pay you later)

Pensions are claims.

When institutions make bad bets, those promises weaken.