The Quiet Shift in Global Finance: Why BRICS and mBridge Matter More Than You Think

While most headlines obsess over interest rates, inflation prints, and stock market rallies, a far more important shift in global finance is happening quietly—almost unnoticed. It isn’t loud, political, or dramatic. It’s infrastructural. And history shows that when financial infrastructure changes, power follows.

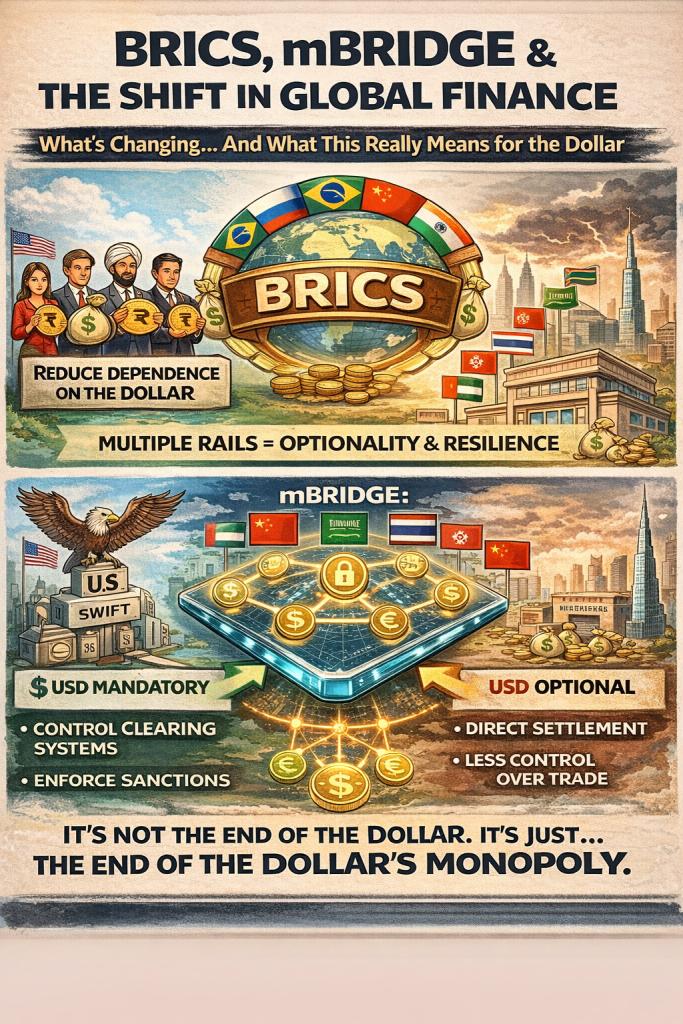

This shift centers on two things: BRICS and a payment system called mBridge.

This isn’t about conspiracy theories or the collapse of the U.S. dollar. It’s about something more subtle—and more durable: countries building alternatives so they are no longer dependent on a single financial gatekeeper.

What BRICS Really Is (and What It Isn’t)

BRICS—Brazil, Russia, India, China, and South Africa—is often misunderstood. It is not a unified bloc, not a military alliance, and not a single currency project.

At its core, BRICS is a coordination effort among large emerging economies to:

- Trade more efficiently

- Finance development outside Western institutions

- Reduce exposure to foreign political and financial risk

The key word is optionality. BRICS countries are not trying to overthrow the global system; they are trying to avoid being trapped inside one system they do not control.

Enter mBridge: The Infrastructure Everyone Is Missing

mBridge (short for Multiple Central Bank Digital Currency Bridge) is where the real change is happening.

Unlike SWIFT, which only sends payment messages between banks, mBridge actually settles money—directly between central banks—using digital versions of national currencies.

In simple terms:

- No correspondent banks

- Fewer intermediaries

- Faster settlement (seconds instead of days)

- Lower costs

- Less exposure to foreign jurisdictions

This is not a theoretical experiment. Pilot programs involving China, the UAE, Thailand, Hong Kong, and Saudi Arabia have already processed real transactions.

The system doesn’t replace national currencies. Each country keeps full monetary sovereignty. mBridge simply acts as a neutral settlement layer, translating currencies instantly at the point of trade.

Why This Matters for the Dollar (Without the Drama)

The U.S. dollar remains dominant—and will for a long time. But its power comes from more than trust. It also comes from control of financial plumbing: clearing systems, correspondent banks, and legal jurisdiction.

mBridge doesn’t “kill” the dollar.

It reduces dependence on it.

That distinction is crucial.

When countries can settle trade directly—without routing payments through New York or converting into USD—they gain resilience. Sanctions become harder to enforce. Financial pressure becomes less absolute. Influence shifts from enforcement to negotiation.

This is not an attack. It’s insurance.

The Sanctions Question: Why Infrastructure Changes Everything

For decades, sanctions have worked because global trade flowed through a small number of financial chokepoints. Control the pipes, and you control the flow.

mBridge removes many of those chokepoints.

If two central banks agree to trade and settle through a shared ledger, there is:

- No intermediary to pressure

- No message to block

- No account sitting in a foreign jurisdiction to freeze

Sanctions don’t disappear—but their effectiveness weakens when countries have alternatives.

This is why infrastructure matters more than policy announcements.

The “60% of Global GDP” Claim—Properly Explained

You may hear claims that mBridge could involve countries representing 60% of global GDP. This does not mean:

- 60% of trade is already settled this way

- The system is fully live everywhere

- The dollar is irrelevant

It means many countries are:

- In advanced discussions

- Testing integration

- Preparing optional connectivity

This is about network potential, not current dominance.

The Three-Phase Transition Now Underway

Phase 1: Infrastructure (Happening Now)

Pilot programs, limited corridors, real settlements, proof of concept.

Phase 2: Expansion (Next 1–2 Years)

More countries join. More currencies integrate. Trade settlement increasingly bypasses USD where convenient.

Phase 3: Multipolar Default (Long Term)

Countries choose settlement rails based on efficiency, neutrality, and risk—not ideology.

The dollar remains important, but no longer mandatory.

The Bigger Picture: This Is About Stability, Not Power

Despite dramatic headlines, this shift is not about replacing one empire with another. It’s about reducing systemic fragility.

A world with one financial rail is efficient—until it isn’t. A world with multiple rails is more complex—but more stable.

History shows that power rarely collapses overnight. It erodes gradually, through alternatives, not revolutions.

That process is already underway.

Final Thought

Most people are watching markets.

Some are watching currencies.

Very few are watching infrastructure.

But infrastructure decides the future.

The world isn’t abandoning the dollar.

It’s building options.

And once options exist, leverage changes forever!