What is this about?

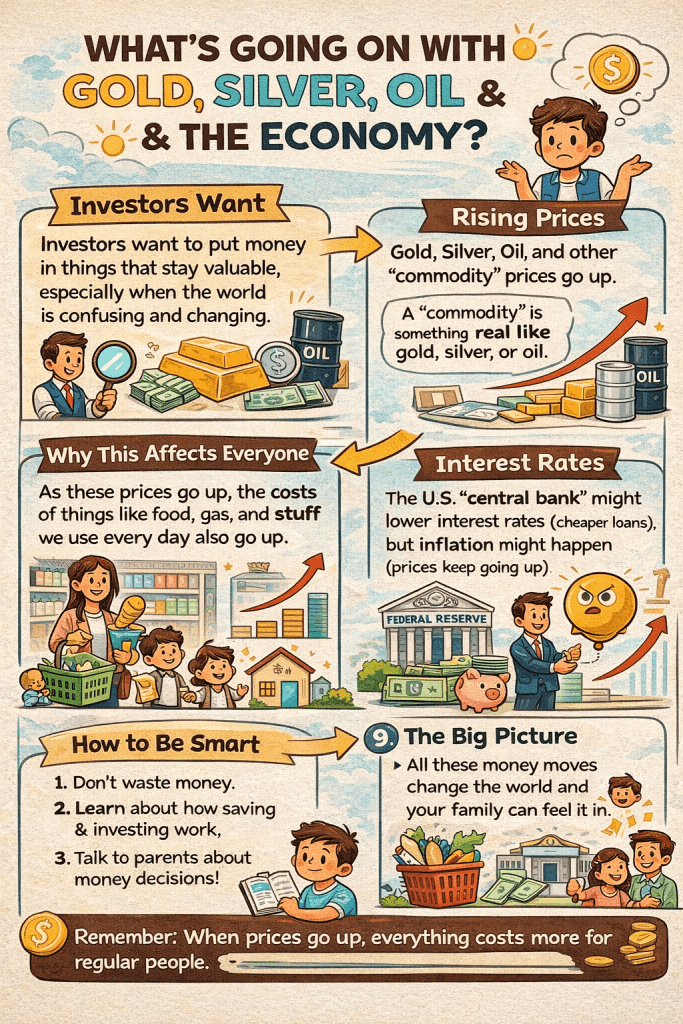

This is about how prices of important things like gold, silver, oil, stocks, and crypto are moving, and how big decisions by governments and central banks (like interest rates) affect the whole economy.

Big idea in simple words:

Money is moving around the world, and investors are trying to guess what will be worth more in the future. Right now, many experts think commodities (real physical things like gold, silver, copper, and oil) will become more valuable by 2026.

Why are people talking about gold and silver?

- Silver is used in phones, solar panels, and electric cars, so demand is rising.

- Gold is like a safety shield—when people feel worried about the economy, they buy gold.

- Central banks and big investors are buying gold, which helps support its price.

What about stocks and crypto?

- Stocks are a bit shaky because everyone is waiting for jobs data to see if interest rates will be cut.

- Crypto like Bitcoin is falling a bit, but some coins (like Ethereum) look more stable.

- Investors are unsure, so markets move up and down a lot.

Why do interest rates matter?

- Lower interest rates → borrowing is cheaper → people spend more → prices of assets often rise.

- Higher interest rates → borrowing is expensive → people spend less → markets slow down.

- Everyone is waiting to see what the U.S. central bank (the Fed) will do next.

How does this affect a common person?

- Groceries and gas: Prices can rise if commodities go up.

- Jobs: Companies may hire less if the economy slows.

- Savings: Cash loses value if inflation stays high.

- Investments: Stocks, real estate, and retirement funds move with these markets.

Why do experts like commodities right now?

Because:

- There isn’t enough supply.

- The world is changing (clean energy, electric cars, wars, global tension).

- Governments keep printing money, which makes real assets more valuable.

The world economy is uncertain, so investors are moving money into real things like gold and silver, while watching interest rates closely. If prices rise, everyday people feel it through higher costs of living, even if they never invest at all.