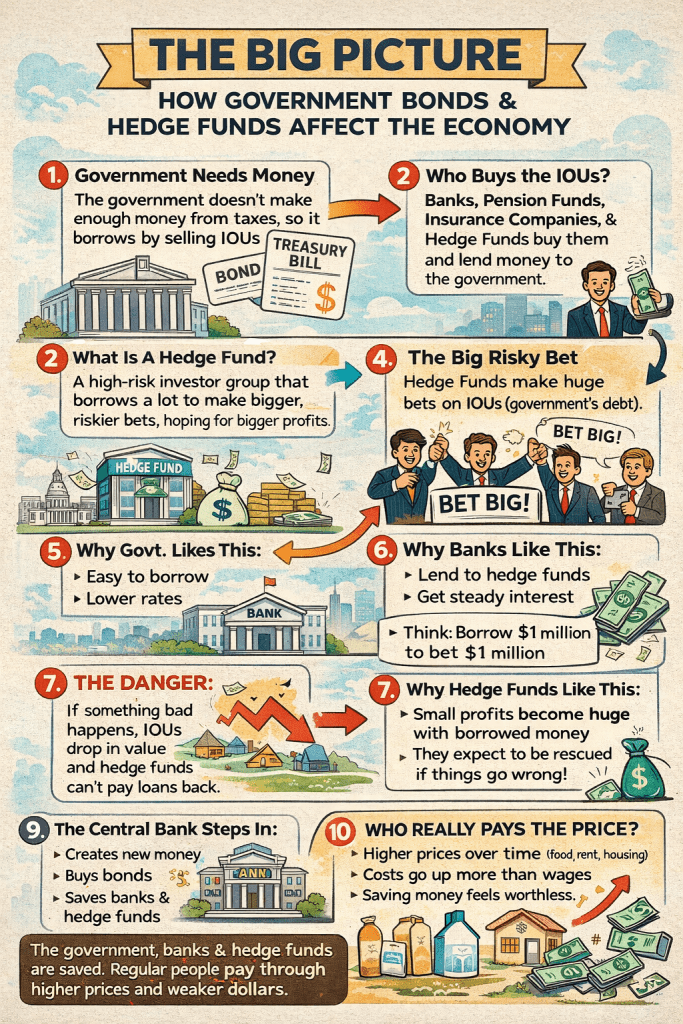

The Big Picture

Think of the economy like a giant school fundraiser.

1. How the government gets money

The government doesn’t earn enough from taxes, so it borrows money.

It does this by selling Treasury bills and bonds (IOUs that promise to pay back later with interest).

- Treasury bills (T-bills): short-term IOUs

- Bonds: long-term IOUs

People who buy these are lending money to the government.

2. Who buys government bonds?

Several groups:

- Banks

- Pension funds

- Insurance companies

- Hedge funds (very important here)

3. What is a hedge fund (simple)?

A hedge fund is like a high-risk professional investor group that:

- Borrows a lot of money

- Makes small price bets

- Tries to multiply profits using leverage (borrowed money)

Think:

Borrow $100 to make $2 profit → sounds small

Borrow $1,000,000 to make the same bet → now it’s big money

4. What risky bet are hedge funds making?

They are making huge bets on government bonds, using borrowed money.

They:

- Buy government bonds

- Borrow money using those same bonds as collateral

- Buy even more bonds

This creates a loop:

Bonds → Borrow → Buy more bonds → Borrow more

5. Why does the government like this?

Because:

- More buyers = bonds sell easily

- More demand = lower interest rates

- Government can borrow cheaply

So the government benefits.

6. Why banks like this

Banks lend money to hedge funds.

- Hedge funds pay interest

- Banks earn steady profit

Banks benefit.

7. Why hedge funds like this

Even though the profit per trade is small:

- Borrowing huge amounts makes profits very large

- They believe they’ll be rescued if things go wrong

Hedge funds benefit.

8. Where is the danger?

If something bad happens (war, crisis, panic, sudden bond price drop):

- Bond prices fall

- Hedge funds can’t repay loans

- Banks face losses

- Everyone rushes to sell at once

This causes a liquidity crisis (not enough cash).

9. What does the central bank do then?

The Bank of Canada steps in and:

- Creates new money

- Buys government bonds

- Saves banks and hedge funds

This prevents a collapse — but has a cost.

10. Who really pays the price? (Common people)

Over time:

- More money printing = higher prices

- Food, rent, housing go up

- Wages don’t rise as fast

So:

- People who own assets (stocks, real estate) get richer

- People who work and save cash fall behind

The Truth is

The system survives by borrowing more and more money, protecting governments, banks, and hedge funds first—while everyday people quietly pay through higher prices and a weaker dollar.