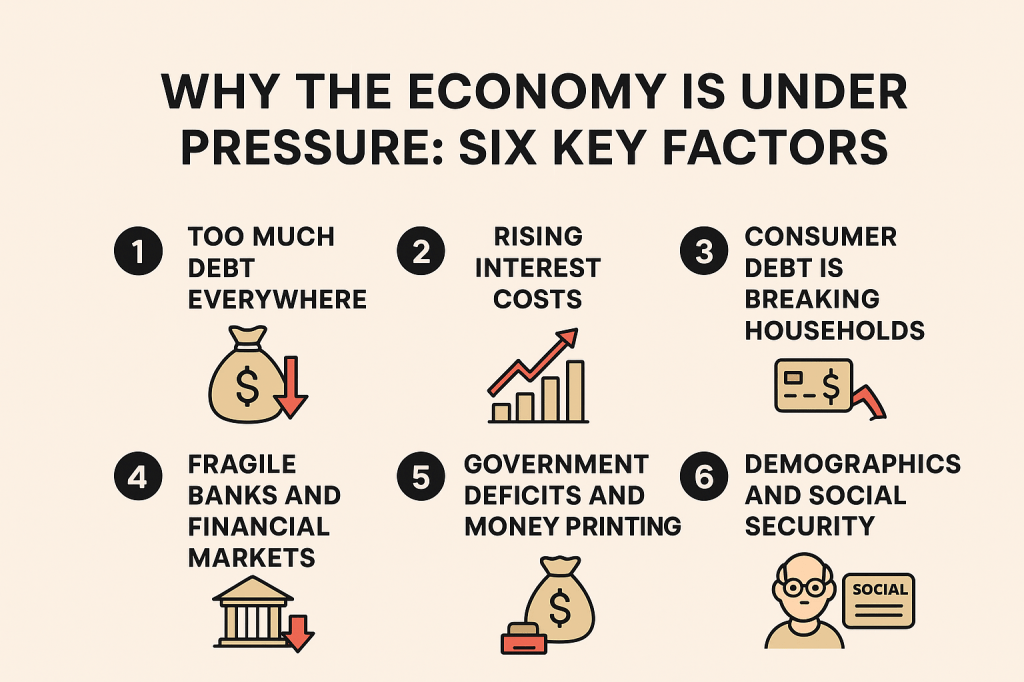

Many people feel that something is “off” in the economy but can’t quite explain why. Jobs still exist, markets haven’t collapsed, and life seems mostly normal. But beneath the surface, serious pressures are building. These pressures come from six major factors working together—not one single event.

Here they are, explained simply.

Factor 1: Too Much Debt Everywhere

The U.S. government, businesses, and households are carrying more debt than ever before. When debt grows faster than income, it becomes harder to manage—especially when interest rates rise. Eventually, more money goes to interest instead of growth, spending, or savings.

Factor 2: Rising Interest Costs

As interest rates increase, the cost of servicing debt explodes. The government now spends hundreds of billions each year just paying interest. That money produces nothing—it doesn’t build roads, improve healthcare, or grow the economy. It simply keeps the system running.

Factor 3: Consumer Debt Is Breaking Households

Credit cards, auto loans, and mortgages are eating up a larger share of household income. When people spend more just to service debt, they cut back on everything else. That slows the economy and increases the risk of defaults and layoffs.

Factor 4: Fragile Banks and Financial Markets

Banks are under pressure from bad loans, falling asset values, and tighter lending conditions. Markets may look calm one day and panic the next because confidence is thin. When trust breaks, money moves fast—and instability spreads quickly.

Factor 5: Government Deficits and Money Printing

The government continues to spend far more than it collects in taxes. To cover the gap, it borrows or prints money. Borrowing raises interest costs, and printing money fuels inflation. Neither option is painless, and both reduce long-term stability.

Factor 6 (The Most Ignored One): Demographics and Social Security

America is aging fast. The baby boomer generation is retiring, and millions more will retire over the next decade. In 1960, there were about five workers supporting one retiree. Today, there are less than three, and soon there will be only two workers per retiree.

At the same time, Social Security and Medicare payouts are exploding. Together, they now cost over $2 trillion per year, and that number keeps growing as healthcare costs rise and more people retire. These programs are funded by taxes on workers—but there simply aren’t enough workers anymore to support the benefits at current levels.

The Social Security Trust Fund is projected to run out around 2033. By law, that would mean an automatic 23% cut in benefits if nothing changes. Politically, cutting benefits is extremely difficult, so the government will likely step in using general tax revenue—which means higher taxes, more borrowing, more money printing, or all three.

There is no easy solution. This is not ideology or politics—it’s math.

Why This Matters

All six factors reinforce each other. Debt makes rate hikes painful. Aging demographics strain government finances. Weak growth makes deficits worse. Inflation limits policy options. Over time, the system becomes less flexible and more fragile.

This doesn’t mean the economy collapses overnight. It means we enter a long period of lower growth, higher volatility, and declining living standards for many people. Those who understand this early can prepare, reduce risk, and protect themselves.

Final Thought

This is not the end of America—but it is the end of the easy era. The people who do best won’t be the ones who panic, and they won’t be the ones who ignore reality. They’ll be the ones who understand the forces at work and adapt early.